November 2017, decision-makers gather around climate action and energy – in realizing the Paris Climate Agreement at COP23 in Bonn and in delivering the Energy Union in the realm of the State of the Energy Union Address in Brussels: The need to make political ambitions bankable is ON the agenda!

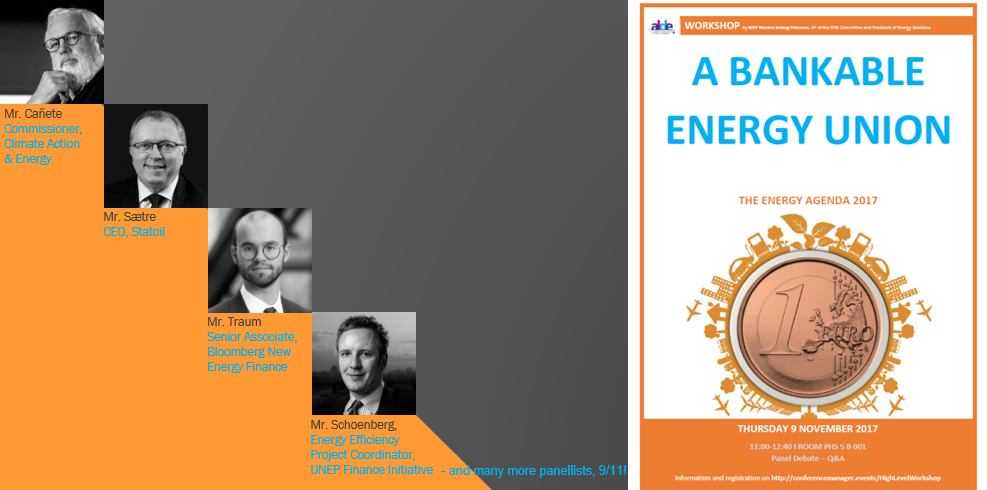

A Bankable Energy Union is the one million dollars – or euro – question at stake on the 9th of November when Commissioner for Climate Action & Energy, Bloomberg New Energy Finance, United Nations Environmental Program, Statoil, GE, E.ON and other key decision-makers meet in bridging finance and energy.

Bridging finance and energy is very much like a couple therapy session, explains Vice Chair for the energy committee (ITRE), Rapporteur for market design (ACER), and President to the European Parliamentary Network on Energy Solutions (Energy Solutions), Morten Helveg Petersen (ALDE):

“A relationship takes two – there should so to say be business in energy and energy in business: At first sight this sounds strange to each party, but fact is that the two parties need to understand one another. Way too often each part is asking with point of departure in own needs for finance and projects, respectively. As policy-maker, I find it absolute crucial to hear both sides and then match needs with solutions – this is Energy Solutions!”

All three actors from policy-makers to financial institutions to yet again energy companies come together on integrated energy solutions at the European Parliament. Behind the high-level session is the European Parliamentary Network on Energy Solutions (Energy Solutions), which was launched only a year ago to enable holistic policy-making across national, sectorial and partial interests in the realisation of a future Energy Union.

Energy Solutions Advisory Board Member to represent the financial side, PKA, earlier this year took on the Chairmanship of the International Investors Group on Climate Change (IIGCC):

“An important agreement was made at COP21 – and now we need to turn ambition into action by means of responsible investments. I will work for more climate-friendly investments both in Europe and emerging markets, where the possibilities and the needs are present. I am therefore pleased to draw on the experience we have within the green agenda from PKA,” says CEO for PKA, Peter Damgaard Jensen.

CEO for PKA and Chairman for IIGCC, Damgaard Jensen emphasizes that the political signaling has emerged lately; but that there is still a grand need for enabling environments for the industry:

“Without clear political guidelines the risks of these type of investments are so high that the expectations on return on investments likewise become too high. Ultimately this results in reduced interest and willingness from investors to engage in climate investments – it is a shame when we as investors do want to invest greener than today,” says Damgaard Jensen.

Advisory Board Member from the energy sector, Statoil, has clear views on the role of investors in the EU energy system:

“Continued success in the next 50 years means energy companies must be part of the response to the great challenges facing the world. We must find more innovative ways, more sustainable ways to provide societies the energy they need. We must adopt a new mindset of radical change, be even more open and collaborative, be competitive at all times and play an active role in the transition to a low-carbon economy”, says Statoil CEO, Eldar Sætre.

The investment agenda of global energy companies will have to be vast in the years to come, covering not only infrastructure but also research and innovation (R&I), digitalisation and venture capital initiatives. CEO Sætre underlines:

“There will therefore be no lack of willingness to invest on our part. We have announced our goal to become the world’s most carbon-efficient oil and gas producer while expecting 15-20% of our annual CAPEX to be directed towards new energy solutions by 2030. Our challenge is to find good and profitable industrial projects, and this is where we look to policy makers to create a marked oriented framework that generates solid investment opportunities and sustain investor confidence.”

Play your part in delivering integrated energy solutions for a bankable Energy Union. Reserve your seat before 5/11 http://conferencemanager.events/HighLevelWorkshop. Read more on @EnerSolutionsEU and www.enersolutions.eu